A look at the recent reform agenda

A short history of the recent reform agenda

The big topic on everyone’s lips at the moment is the King’s speech set for 7th November 2023, and the question that we all want to know the answer to is ‘will there be any kind of announcement about leasehold, and if so, what sort?’

Of course, we will have to wait until then to hear the news, but I thought in the meantime it might be helpful to take stock of where we have been and also to think about how the concept of ‘leasehold reform’ has been brewing over time.

The reform agenda stretches right back 56 years or so to the Leasehold Reform Act 1967 and the question of reform has been around prior to that and there are some good (political) words around this on the blog site of my late friend Louie Burns see:

https://barcode1966.wordpress.com/2018/09/14/the-shameful-history-of-leasehold-reform/

A political story

This is very much a political story, and we are about to stray into political territory. The Law Commission recognised that when they looked at this and indicated that on valuation matters, particularly, they could only look at options for reform – to be discussed and voted on by parliament.

We cannot say with certainty what the government will deliver as it moves from the end of this year into next, when there very certainly will be an election. The parties have all considered leasehold in slightly different ways over the years. However, I am pleased to say, that there is a renewed focus now.

In the light of this I thought that it might be useful to have a look at what has gone on in the recent past as part of setting the scene for a discussion about what is likely to mentioned on the topic of reform and if (for some reason) it is not mentioned then to look very closely at what perhaps should feature in any government’s future list of changes in this sector.

The Potential Reforms in Leasehold

There have been numerous reforms, and a great deal of talk about future changes, in the years since the Government announced that it was going to tackle the thorny and complex question of reforming leasehold ownership.

Recent History

On 21 December 2017, then Housing Secretary Sajid Javid announced the Government’s plans to tackle perceived problems with the leasehold system in England and Wales, following on from the exposure of the so-called ground rent and leasehold houses ‘scandals.’

Leasehold reform was subsequently included in the Law Commission’s 13th Programme of Law Reform, which was tasked with finding ways to fulfil the Government’s intent to make buying a freehold or extending a lease “easier, faster, fairer and cheaper.”

The Law Commission’s work

After numerous consultations, the Law Commission published a series of reports on 21 July 2020:

· A final report on reforming all aspects of leasehold enfranchisement entitled: Leasehold homeownership: buying your freehold or extending your lease

· A final report on Right to Manage: Leasehold home ownership: exercising the Right to Manage

· A final report on Commonhold entitled: Reinvigorating commonhold: the alternative to leasehold ownership

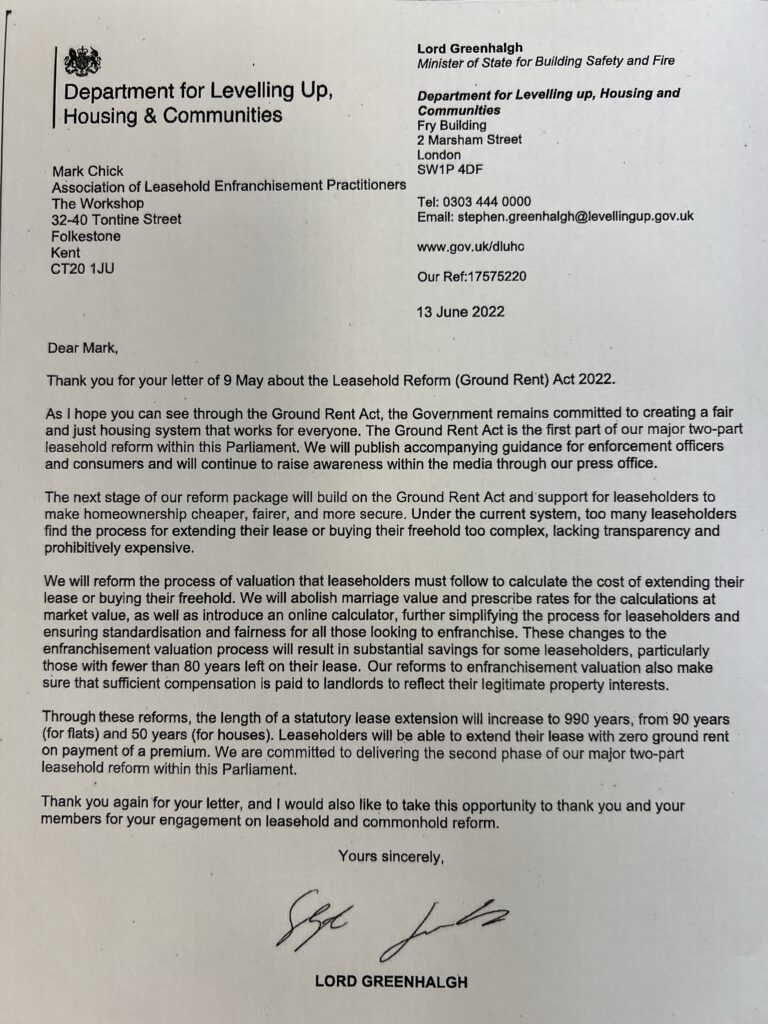

In January 2021 the Government announced legislation would be introduced to set future ground rents to zero as the first part of a two-phased approach to reforming leasehold. The Leasehold Reform (Ground Rent) Act 2022 (‘the Ground Rent Act’) came into force on 30 June 2022 and applies to new lease agreements created on or after that date.

The Ground Rent Act puts an end to ground rents for all new long residential leasehold properties in England and Wales and limits on renewals to the rent that would be paid under the existing lease until the old term comes to an end.

The Act came into force for most new leases on 30 June 2022 (and from 1 April 2023 for leases of retirement homes), abolishing ground rents on all new long leases of flats and houses so that only a peppercorn rent (i.e. zero) can be payable under the terms of the new leases. The legislation does not apply retrospectively, and so long leases entered into prior to the 30 June 2022 are still subject to pay ground rent.

Future reforms

On 11 January 2021 the Secretary of State (then Robert Jenrick) provided additional information on planned reforms in a written ministerial statement. In summary, future legislation will look to address the following points, as part of the second phase of the leasehold reform agenda:

· Reform the process of enfranchisement valuation used to calculate the cost of extending a lease or buying the freehold.

· Abolish marriage value.

· Cap the treatment of ground rents at 0.1% of the freehold value and prescribe rates for the calculations at market value. An online calculator will simplify and standardise the process of enfranchisement.

· Keep existing discounts for improvements made by leaseholders and security of tenure.

· Retain the separate valuation methodology for low-value properties known as “section 9(1)”.

· Give leaseholders of flats and houses the same right to extend their lease agreements “as often as they wish, at zero ground rent, for a term of 990 years”.

· Allow for redevelopment breaks during the last 12 months of the original lease, or the last five years of each period of 90 years of the extension to continue, “subject to existing safeguards and compensation”.

· Enable leaseholders, where they already have a long lease, to buy out the ground rent without having to extend the lease term.

The Building Safety Act, which became law on 28 April 2022, also ushered in additional protections for leaseholders in the wake of the Grenfell Tower tragedy, among them new legislation jettisoning the notion that leaseholders should be the first port of call to pay for historical safety defects, including unsafe cladding, through the service charge.

Timescales

Since then, there has been insufficient parliamentary time to allow the Government to bring forward proposed legislation to address its aims for the second phase of leasehold reform.

On 20 February 2023 Michael Gove, Secretary of State at the Department for Levelling Up, Housing and Communities announced: “We hope, in the forthcoming King’s Speech, to introduce legislation to fundamentally reform the system. Leaseholders, not just in this case but in so many other cases, are held to ransom by freeholders. We need to end this feudal form of tenure and ensure individuals have the right to enjoy their own property fully.”

On Sophie Ridge on Sunday on 29th January 2023 Mr Gove said that he ‘wanted to introduce legislation in the final parliamentary session- later this calendar year to change the leasehold system.’ He went on to describe leasehold as ‘an outdated and feudal system that needs to go.’

Mr Gove seems to have been suggested that leasehold could be abolished altogether, although this appears to have been something of a red herring, while Labour has also claimed it supports the abolition of leasehold ownership.

What happens next?

Everyone will be eagerly awaiting clarity from the Government on what the next tranche of reform legislation will look like.

While the King’s Speech on 7 November will surely include mention of the Government’s future intent, in practise the detailed proposals themselves may not be worked up by the time of the next General Election.

However, regardless of which party forms the next Government the likelihood is that the outcome of the election will not derail the impetus that has built up behind leasehold reform.

The policies themselves and the social aims of the Government of the day will of course have an impact on the trajectory of leasehold reform, and so leaseholders and the practitioners advising them will likely have to wait a little longer before we get a clear sense of how the reform agenda will shape up.

Mark Chick

28th October 2023